In the carousel of concerns that revolve around financial markets, one that’s particularly close to my heart is the subject of EM debt. Troubles in Turkey and Argentina have meant that concerns about financial stability in emerging economies have resurfaced once again in recent weeks. As usual, the commentary has produced more heat than light.

The debt challenges facing Turkey and Argentina are, in many ways, very different. Most obviously, Turkey’s debt is held overwhelmingly by the private sector, while Argentina’s debt is held mainly by the public sector. Yet the nature of the problem facing both countries is essentially the same – they have binged on debt denominated in foreign currency. This has been at the root of pretty much every major EM debt crisis (with the notable exception of Russia in 1998).

Foreign currency debt increases financial vulnerabilities in several important ways. For a start, national central banks can’t stand behind the debt. It also creates currency mismatches that expose domestic balance sheets to swings in the exchange rate. And most importantly, sustaining a large foreign debt burden requires maintaining the confidence of overseas investors.

The good news is that Argentina and Turkey are outliers. We estimate that total outstanding foreign currency debt held by EMs has almost doubled from about $3.0trn in 2008 to around $5.5trn in 2018. At face value that looks dramatic. However, EM GDP has also doubled in US dollar terms over the same period. As a result, measured as a share of GDP, EM foreign currency debt has been broadly stable at just over 15% over the past decade. Argentina’s foreign currency debt burden has increased from 20% to over 65% of GDP since 2013, while Turkey’s has increased from 30% to 70% of GDP. But several other major EMs – including India and Korea – have seen their foreign currency debt burden fall.

Admittedly, given the critical role that exchange rates play in determining FX debt sustainability, we should still consider what might happen if the world’s currency markets were to move against EMs. But this doesn’t materially change the broad picture that problems would be concentrated in a handful of small and medium-sized EMs.

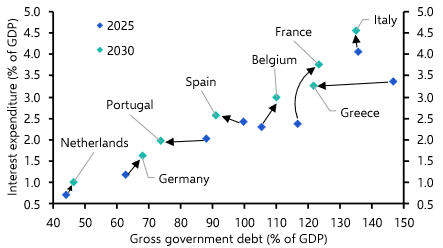

Chart 1 shows our estimates of what would happen to EM foreign currency debt burdens if the major developed world currencies (US dollar, euro, yen and sterling) appreciated by 25% against emerging market currencies. In this scenario, the debt positions of Chile, Romania and Malaysia would start to look vulnerable. But together with Turkey and Argentina, these economies account for just 3.5% of world GDP. It’s difficult to envisage this group causing major problems for the rest of the global economy.

Chart: Foreign Currency Debt (% of GDP)

Stepping back, in many respects Turkey and Argentina are now anachronisms. The past couple of decades have seen a big shift across the emerging world away from foreign-currency denominated debt and towards local-currency denominated debt. The result has been that most EMs can now sustain larger debt burdens.

So can we rest easy? Not quite. As is so often the case, China is the elephant in the room. There is no single source of data, but we estimate that total outstanding local and foreign debt in EMs has more than trebled over the past decade, from $17.3trn in 2008 to $52.7trn today. According to our estimates, China has been responsible for about three-quarters of this increase. Moreover, much of the debt has been used to finance inefficient investment by firms in increasingly unproductive parts of China’s economy.

A significant amount of this debt is likely to turn bad over the coming years. As that happens, China’s government will almost certainly be faced with a large bill for recapitalising the country’s banks.

The fact that China’s debt is overwhelmingly denominated in local currency helps and the government’s balance sheet is strong enough to absorb the costs of recapitalisation. What’s more, capital controls provide a firewall from behind which Beijing can deal with its debt problems without incurring the wrath of global investors. The most likely outcome, in our view, is that China’s debt problems manifest themselves in a prolonged period of depressed growth rather than the short, sharp shock that is typical of most EM debt crises. But Beijing is walking a tightrope and, as we’ll argue in a forthcoming publication, there are several plausible ways in which China’s economy could come crashing down. (If you’re interested in seeing this piece when it’s published drop me an email. As a spoiler, the big risks lie with property developers.)

None of this has yet entered our baseline forecast. But it does illustrate that, rather than focusing on problems in Turkey or Argentina, the markets should shift their view further east – like most things nowadays, if EMs are to be the source of a global crisis it is likely to be made in China.

In case you missed it:

(Requires login)

- Jennifer McKeown picks apart the re-escalation in trade tensions between the US and China and analyses the economic and market implications.

- Our Latin America Economist, Edward Glossop, explains why we’re entering a critical phase of Brazil’s pension reform.

- Our markets team have published their latest Global Markets Outlook, which contains analysis and forecasts for all major asset classes. Read more here.