The continued weakness in key economic data, together with the recent abrupt change in tone by the European Central Bank, has prompted renewed questions about the health of the global economy. At times of heightened uncertainty, I think it’s useful to split any analysis into three parts: what we know, what we think we know and what we don’t yet know.

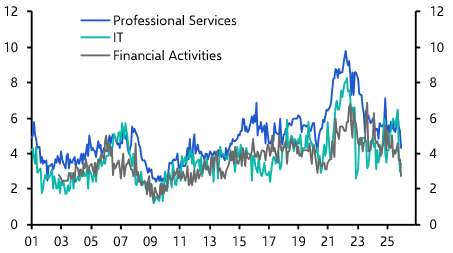

Let’s start with what we know. First and foremost, there’s growing evidence that the global economy is losing steam. As Chart 1 shows, a broad range of survey indicators have turned lower over the past quarter or so. All told, we reckon that global GDP growth has slowed from 3.8% y/y in the first quarter of last year to around 3% y/y now. That may not sound like a big deal but keep in mind that the IMF has previously suggested that a figure below 3% constitutes a global recession. So this looks serious.

Chart 1: Indicators of Economic Activity (Standardised, LR Avg = 100)

We also know that, while the slowdown in growth has been widespread, it has been particularly severe in Europe and, to a lesser extent, Asia. The US economy has held up relatively well so far, but the monthly activity data and business surveys are now pointing to a more marked slowdown in growth in Q1.

And we know that, at a sectoral level, manufacturing has borne the brunt of the downturn. The counterpart of this has been a sharp decline in global trade. In contrast, the service sector has been comparatively resilient.

What about the things that we think we know? These relate mainly to the causes of the downturn. One-off factors appear to have played a role in some countries, particularly in the euro-zone, where vehicle production has been affected by the disruption caused by new emissions regulations.

But something more fundamental also seems to be afoot. As we’ve noted before, the trade war between the US and China is likely to have had some effect on world growth, but this is only a small part of the story. Instead, as I argued a few weeks ago, the most likely explanation for the slowdown in global growth is that country-specific problems have started to weigh on activity in the world’s three major economic regions – the US, China and Europe – which have then been amplified through various feedback loops. In addition to this, it’s possible that political uncertainties are beginning to weigh on business investment in some countries (especially in Europe) and that a particularly large inventory cycle may be starting to unwind in the tech sector.

If all of this sounds a bit unsatisfactory then it’s worth bearing in mind that it’s common for global downturns to have their roots in several different areas. The last downturn in 2008-09 was unusual both because of its size but also because it had a single cause (debt and housing).

This leaves the things that we don’t yet know. The big question here is: how severe will this downturn be? It’s possible to envisage that all of this blows over relatively quickly. The one-off factors that have weighed on growth in some regions will fade, a trade truce between the US and China may help to shore up business sentiment and central banks may come to the rescue. It’s equally easy to see how things could spiral downwards. After all, the recovery from the 2008-09 crisis has been unusual in several respects: growth has been unusually weak, debt levels remain unusually high, policy has been unusually supportive and asset prices remain unusually high. Against this backdrop, it wouldn’t be a surprise if the global economy now experienced a sharp slowdown.

I suspect that the reality will lie somewhere in between. Growth in the euro-zone is likely to pick up over the next quarter or so as some of the headwinds that have been weighing on the region fade. Meanwhile, policy support should eventually help to stabilise growth in China, probably from the middle of this year. But at the same time new challenges will emerge. In particular, we expect that the US economy will remain weak through the course of 2019 and into 2020 as the sugar-high from last year’s fiscal stimulus wears off and the lagged effects of earlier Fed tightening weighs on interest rate sensitive sectors of the economy (notably housing).

The net result of this is likely to be that global growth remains depressed over the next year or so. We don’t anticipate a downturn on the same scale as 2008-09, but we do expect world GDP growth to fall below 3% y/y over the course of 2019-20. That would be a worse outcome than most analysts (and policymakers) currently anticipate – and it is likely to produce a combination of weaker stock markets, lower bond yields and renewed loosening by the world’s major central banks.

In case you missed it:

- Our Chief UK Economist, Paul Dales, takes stock of last week’s developments on Brexit and assesses the implications for the economy and financial markets.

- Our Chief Markets Economist, John Higgins, explains why a blockbuster decade for US equities may be coming to an end.

- Our Chief EM Economist, William Jackson, looks at the recent surge in foreign currency bond issuance across EMs and analyses the economic and market implications.