After being named the number one UK economy forecaster by the Sunday Times for a third time, Capital Economics explained why we think the Bank of England will raise interest rates by more than the consensus expects, causing a deeper recession this year than most anticipate.

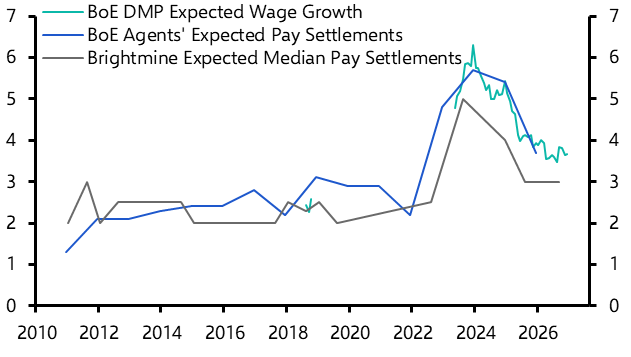

The UK Economics team, led by Paul Dales, advised clients in a new report that easing energy prices will help CPI inflation fall rapidly this year – but not as far as most forecasters believe. It also warned that wage inflation wouldn’t cool enough to satisfy the Bank of England, and that policymakers would therefore keep interest rates elevated to push up the unemployment rate.

Although these pressures will conspire to cause a recession this year that’s deeper than the consensus currently expects, the team also explained how this feeds into our non-consensus forecasts for the UK economy’s recovery in 2024.

The Sunday Times announced on 19th February that Capital Economics topped a table of 30 forecasters for accuracy, based on 2022 forecasts for variables including GDP growth, inflation, Bank Rate and unemployment, made in December 2021 or January 2022.

The team of Paul Dales, Ruth Gregoryand Ashley Webb was named most accurate forecaster because of its insight that inflation would rise further than most expected, requiring a tougher Bank of England response than other forecasters anticipated.

To receive our free report on the UK economic outlook, including our 2023 and 2024 forecasts, click here.