Markets may have staged a meaty rally in the wake of the softer-than-expected October CPI print, but we’re not convinced the good times will last. Our latest Global Markets Outlook warns that a looming global recession means “risky” assets will struggle until around the middle of next year.

The report, which has been prepared by Thomas Mathews, Diana Iovanel and Filippos Papasavvas from our Markets team and by Jennifer McKeown, the head of our Global Economics service, shows how we think asset prices will fare in light of our downgraded view of global growth.

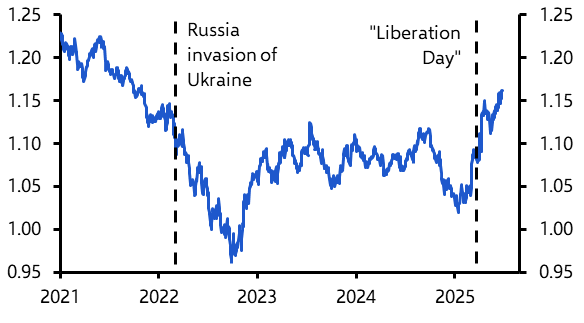

Our Global Economics team has cut its 2023 growth forecast to just 1.7%, meeting the old IMF definition of a recession, as aggressive monetary tightening takes its toll. The report explains why we think recent rallies in government bond markets could continue, but also warns that falling yields may not provide much support to “risky” assets.

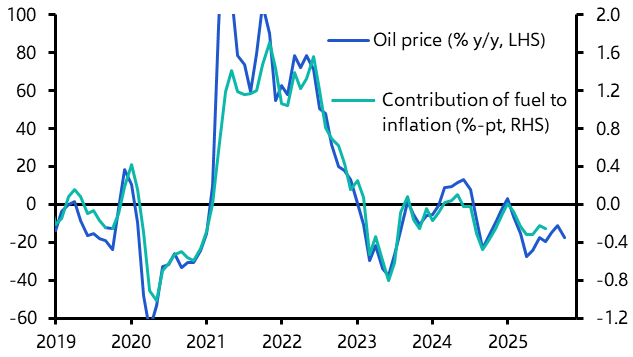

The report shows how we think major developed and emerging market central banks will continue with aggressive tightening for now, but also looks ahead to how faltering growth and easing inflationary pressure could create conditions for a recovery.

“By mid-2023 or so the worst may be behind us and risky assets could, in our view, start to rally again on a more sustained basis,” the report’s authors said.