According to ECB head Christine Lagarde, it threatens “lasting instability resulting in lower growth, higher costs and more uncertain trade partnerships”. The IMF warns it is “unlikely to achieve progress for all, or to successfully tackle global challenges such as climate change or pandemic preparedness.”

When we first began to talk about global fracturing more than a year ago it was a fringe idea that received pushback from some commentators. The fact that what the IMF calls “geoeconomic fragmentation” now shapes debate at the highest echelons of global policymaking – it dominated discussion at semi-annual gathering of finance ministers and central bank heads in Washington this month – illustrates the extent to which the idea of fracturing has entered the mainstream.

With that said, there are several differences between our analysis and that of the IMF and others – with important implications for economic and market outcomes.

The central rivalry

The key, in our view, is to understand precisely what is causing the world to coalesce into competing blocs of US and China-aligned economies. The era of globalisation that reshaped the world in the 1990s and 2000s was underpinned by a belief that economic integration would lead to China and the former Eastern Bloc countries becoming what former World Bank President Robert Zoellick termed “responsible stakeholders” within the global system.

But rather than becoming a strategic partner, China instead emerged as a strategic rival to the United States. It is this rivalry that now lies at the heart of economic fragmentation. It is forcing other countries to pick sides such that the world is fracturing into US-led and China-led blocs. And crucially, policy choices within these blocs are being shaped increasingly by geopolitical considerations.

Framing the process in this way leads to several important conclusions. One is that, while the IMF and others describe geoeconomic fragmentation as a challenge that must somehow be overcome, the reality is that it is something that people on both sides are actively pushing for. Fragmentation is something that companies and investors will have to manage and adapt to over the coming decade.

Fractured, not ruptured

Set against this, when viewed through the lens of geopolitics, it is unlikely that the fracturing process will lead to the complete rupture in the global economy that some now fear. There are no compelling geopolitical reasons why the US or Europe should stop importing most consumer goods from China. The vast majority of trade between the two blocs is likely to continue in much the same way as it has over the past decade. Instead, where trade is affected, it is likely to be in areas that are deemed to be strategically significant such as batteries, biotechnology and high-end manufacturing.

Likewise, while there will be a significant financial element to fragmentation, we won’t see a complete rollback of the globalisation of finance that has taken place over the past couple of decades. Some capital flows between the US and China will reduce. But flows between the US and Europe will be unaffected. And fears that it will ultimately undermine the dollar’s position as the world’s reserve currency are overdone.

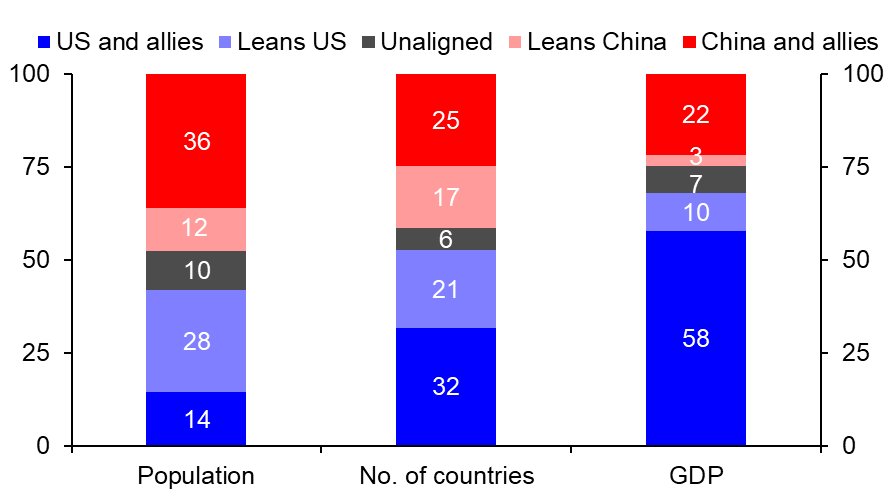

One reason for this is that, while the impression is often given that the world is splitting down the middle, the reality is different. The world’s leading economies, apart from China, are almost all close allies of the US. In contrast, economies that align with China are smaller. Accordingly, the economic heft of the China bloc is likely to be smaller than that of the US bloc. (See Chart 1.)

|

Chart 1: The Shape of a Fractured World (%) |

|

|

|

Sources: Bloomberg, Refinitiv, Capital Economics |

Sizing up the blocs

Just as important, the China bloc is likely to be less economically diverse. Whereas our analysis suggests that the US bloc is likely to comprise the major advanced economies, including Japan, the euro-zone, Canada, Australia and the UK, leading tech exporters such as Korea and Taiwan, and EM manufacturers ranging from Mexico to Poland to Vietnam, the China bloc is likely to be made up principally of large commodity producers. (Our methodology for allocating countries to blocs can be found here.)

This will give China an edge in some areas, including securing supplies of critical minerals needed for the green transition. But the lack of economic diversity within its bloc will ultimately make it harder for China to adapt to the challenges posed by fracturing.

So what does all of this mean? Economists tend to frame everything in terms of the effect on GDP. But in the case of fracturing, attempts to estimate the hit to GDP are largely meaningless. While a more fragmented world economy would lead to a less efficient allocation of resources, the aggregate costs are likely to be small and overwhelmed by other factors. Note that while globalisation should in theory have improved the allocation of resources within advanced economies, GDP growth across developed markets slowed during much of globalisation’s heyday from 1995 to 2007. (See Chart 2.)

|

Chart 2: G7 GDP Growth (% y/y, 5yr Avg.) |

|

|

|

Sources: Bloomberg, Refinitiv, Capital Economics |

Instead, the effects of economic fragmentation will be felt at a more granular level. The implications for commodity markets are significant, as we discuss at length here. Likewise, debt restructuring will become more difficult in a fractured world, with consequences for frontier markets in particular. Among the key protagonists, China has more to lose than the US, but fracturing is only one reason why we expect GDP growth to slow to 2% by the end of this decade. (Demographic challenges and increasing distortions from an unbalanced and increasingly centralised growth model are bigger economic headwinds.)

Fracturing will be a dominant theme over the coming decade. It will make the global economy more volatile and force companies to rethink how they operate. But, by the same token, many features of the globalised world will endure. The key to navigating a fragmented world is to understand the forces that are driving it.

In case you missed it:

- Deputy Chief UK Economist Ruth Gregory explained why UK inflation is higher than others.

- Although this year’s rally in US equities has been almost entirely driven by growth stocks, Senior Markets Economist Oliver Allen shows why we think they will underperform value over the long term.

- Our Japan team explained why they think new BOJ Governor Kazuo Ueda could surprise markets next week. Join the team’s online briefing on the BOJ’s April decision on 28th April, which you can register for here.