With the US election approaching, questions about its economic and market impact are on the rise. In our recent special briefing, our senior economists offered critical insights into the possible economic shifts resulting from this election, covering the implications for both the US and global markets.

Domestic Economic Policy Shifts

A primary focus is on how different outcomes could alter fiscal and trade policies. If Trump wins, substantial tariffs — potentially 10-20% universally on imports and 60% specifically on Chinese goods — are expected. This policy shift could elevate inflationary pressures and reshape supply chains. In contrast, a Harris victory would likely see policy continuity, maintaining current economic conditions, including supporting employment and inflation targets.

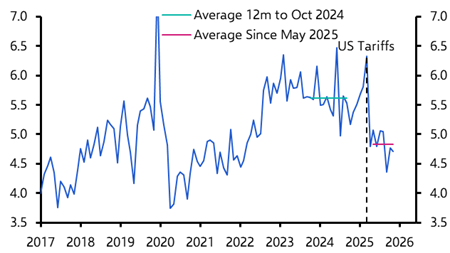

Tariffs and Trade Relations

Trump’s potential tariffs could affect trade dynamics worldwide. We expect an increase in inflation if these tariffs are enacted, as companies pass on higher import costs to consumers. However, the approach to tariffs isn’t solely about the US. It could spur countermeasures from China and other key trading partners, who may impose their tariffs or adjust currency policies to lessen impacts on their economies.

Impact on the Labor Market

Policies targeting immigration could also impact labor markets. For instance, Trump’s stance on restricting immigration may decrease labor supply, pushing up wages in specific sectors and adding inflationary pressures. This outcome could lead to further action from the Federal Reserve to manage inflation.

Implications for Financial Markets

The US stock and bond markets are expected to react to shifts in fiscal and trade policy. For instance, an increase in tariffs and reduced immigration could support a stronger dollar and higher Treasury yields, raising debt costs and leading to a more cautious approach from investors.

Global Market Reactions

Outside the US, we highlighted the effects of these possible changes. In particular, EMs could face pressures on their currencies and trade balances due to a stronger US dollar and shifting demand patterns. The EU and other global players may also respond strategically, either through retaliatory tariffs or alternative alliances to mitigate trade risks.

Watch the Full Briefing On-Demand

These are just a few of the main points covered by the economists in our exclusive US election preview drop-in. To learn more about what’s at stake and how the results could shape the economic landscape, watch the on-demand recording of this special briefing with our experts.