Yogi Berra is often quoted as saying “it’s tough to make predictions, especially about the future”. Long-term forecasting is especially tough. This is a problem of time frames: forecasting what will happen to economies over the next month is easier than over the next year. And it is correspondingly easier to forecast the next year than it is the next decade.

This is partly because economies are vulnerable to unanticipated shocks – and the longer the time horizon the greater the likelihood of a shock occurring. An accurate forecast of the first 25 years of this century would have needed to have foreseen the largest global financial crisis since the Great Depression, a sovereign debt crisis in Europe, the UK’s exit from the EU, a once-in-a-century pandemic, and another war in Europe.

More fundamentally, economies are complex systems that are constantly evolving over time. Most long run forecasts run a straight line through the recent past and project it forward over many years. But even in the absence of shocks, the continuous evolution of economies means that what we can be reasonably sure about is that the next decade will look nothing like the last.

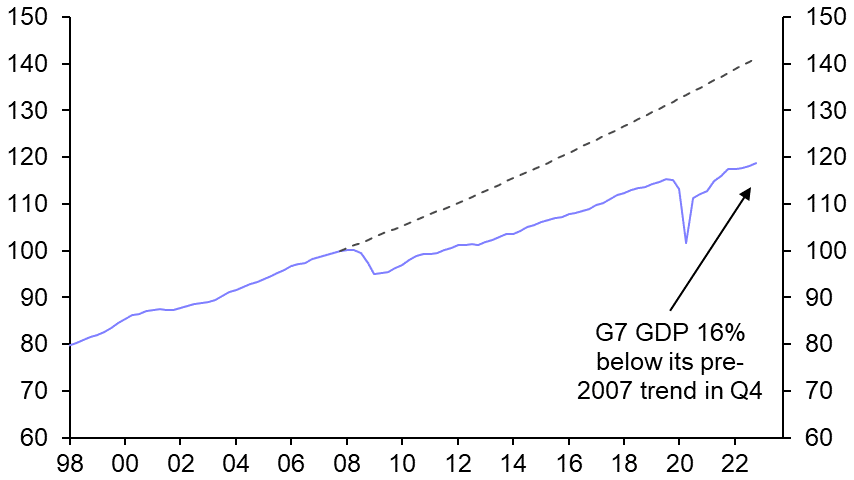

As we note in our latest Long Run Economic Outlook, published last week, the salient feature of the past fifteen years has been chronically weak growth in advanced economies. In the decade before 2007, GDP growth across G7 economies averaged 2.4% a year. In the fifteen years since, it has averaged just 1.2%. Accordingly, GDP in the G7 is now around 16% below its pre-2007 trend. (See Chart 1.)

|

Chart 1: G7 Real GDP (SA, Q4 2007 = 100) |

|

|

| Sources: Refinitiv, Capital Economics |

Solving the productivity puzzle

At the heart of the problem is a long-term decline in productivity growth in advanced economies. (See Chart 2.) The puzzle is that this productivity slowdown has occurred despite the continued rapid development and spread of new digital technologies. These technologies have transformed how we live and work but not, it seems, made us more productive.

|

Chart 2: G7 Output Per Hour Worked (% y/y, 10y rolling average) |

|

|

| Sources: Refinitiv, Capital Economics |

This weakness in productivity is in part a hangover from the Global Financial Crisis. Highly productive parts of the economy shrank – not least finance – and the process of balance sheet repair in the corporate and financial sectors held back investment. In the UK, this was exacerbated by Brexit. Structural factors are also holding back productivity growth. These include an increasing concentration of market power within a few firms, particularly in the US, and a corporate culture that favours short-term shareholder returns over long term investment.

These are all formidable challenges for policymakers to overcome and it would take a true optimist to expect a substantial rebound in productivity growth over the coming decade. But at the same time, some of the pessimism over the long-run outlook is overdone. In its latest forecasts, the Bank of England suggested that the UK can no longer sustain a growth rate of more than 1% a year without generating inflation. That would be the slowest pace of sustained expansion since the dawn of the Industrial Revolution.

Labour supply growth in advanced economies is likely to remain weak over the coming years as demographic headwinds hit the workforce and political considerations prevent an offsetting rise in immigration. But it’s possible to foresee a rise in productivity growth as some of the post-GFC pressures fade and the benefits of new technologies are finally felt.

One of the lessons from history is that it takes time for infrastructure and processes to adapt to new technologies. In 1987, Nobel Prize-winning economist Robert Solow said that the computer age was “everywhere but the productivity statistics”. But by the mid-1990s what became known as the Solow Paradox had been solved as productivity in the US and other advanced economies accelerated. It’s possible – indeed, likely – that something similar will play out with digital technologies.

Pessimism overdone

We don’t expect a surge in long-run GDP growth in advanced economies. But we do think that a pick-up in productivity growth will more than offset the drop-off in labour force growth – meaning that some of the more gloomy long-run forecasts will prove to be too pessimistic. By the end of the decade we think the US will be growing by a little over 2% a year and European economies a little under 2%. That’s not great by historical standards and it will create difficult policy choices, but it’s not as bad as the gloomsters predict.

Likewise, while a return to below-target rates of inflation seen before the pandemic is unlikely, we think that inflation will fall back and settle at rates of 2-3% over the long run. The point of maximum danger was when central banks appeared to have gone soft on inflation. Forceful action now makes a period of structurally higher inflation in the future less likely. Taken together, and the long-term outlook starts to look a little less gloomy.

While some of the pessimism over the long-run outlook for advanced economies is overdone, the consensus on China’s long-term fortunes looks too optimistic.

An abrupt shift to more growth-friendly policies means a strong cyclical rebound is likely this year. But it’s increasingly clear that the drivers of China’s growth model are no longer functioning. A two-decade-long housing boom has ended, banks are lumbered with loans delivering poor returns, and global fracturing will constrain the export sector’s ability to keep gaining market share. At the same time, Xi Jinping’s desire to tighten state control of key sectors of the economy and boost self-sufficiency will increasingly weigh on productivity growth.

Add in demographic pressures that are an order of magnitude greater than those in the West, and we think that potential GDP growth will slow to 2% a year by the start of the next decade.

The result of all of this is that the world in 2035 is likely to look different from what most expect. Economic growth in advanced economies may have picked up a bit, while growth in China is likely to have slowed considerably. Inflation is likely to have been tamed. And the US will probably still be the world’s largest economy. (See Chart 3.)

|

Chart 3: CE Projections for US & China GDP (market exchange rate, $trn) |

|

|

| Sources: Refinitiv, Capital Economics |

Perhaps more importantly, the way that economies and some global companies interact is likely to have altered substantially. The globalisation and multilateralism of the 2000s will have given way to a more fractured world economy, that will pose operating challenges for companies and policy challenges for governments.

Not much of any of this is evident from a read of contemporary economic data, and this is the major flaw with models that rely on extrapolating from the recent past: forecasting out along a straight line will always let you down. As Yogi Berra also said, “the future ain’t what it used to be”.

In case you missed it:

- The size and sustainability of China’s property rebound is one of 2023’s big macroeconomic questions. Chief Asia Economist Mark Williams explains what to expect.

- Nigerians go to the polls this weekend for a crunch presidential election. This dedicated page hosts all our key coverage around the election and the country’s economic challenges.

- This week marks the one year anniversary of Russia’s invasion of Ukraine. In the latest episode of our podcast, Andrew Kenningham and Liam Peach discuss how the war has changed the economies of Europe.