After a tough 2022 and 2023, global trade finally showed signs of life in the first half of this year. But the outlook looks challenging, with our Global Economics team identifying five key risks which threaten this recovery:

- The most immediate threat is a potential strike by US East and Gulf Coast port workers. Over 4% of global goods exports and 3% of imports pass through these ports, with Latin American imports particularly vulnerable. A coastwide strike could start on 1st October if ports and the union fail to come to agreement. But a walk-out would be highly disruptive and that suggests any strike action would not last long. President Biden could intervene, potentially invoking the Taft-Hartley Act to force a resolution, similar to President Bush's actions during the 2002 West Coast lockout. Despite disruptions, US imports remained stable during that period, and world trade continued to grow.

- China’s global market share has expanded beyond semiconductors and green tech, with its share of global goods exports rising from 15% to over 17% between mid-2020 and mid-2023. This growth, driven by China’s increasing manufacturing capacity and weak domestic demand, has resulted in excess supply and aggressive discounting, reducing global export prices by around 2%. While claims of China exporting deflation are overstated, this has slightly lowered global inflation. Overcapacity is likely to persist as China continues investing in manufacturing, supporting strong exports and subdued imports, which may intensify trade tensions as the imbalance grows.

|

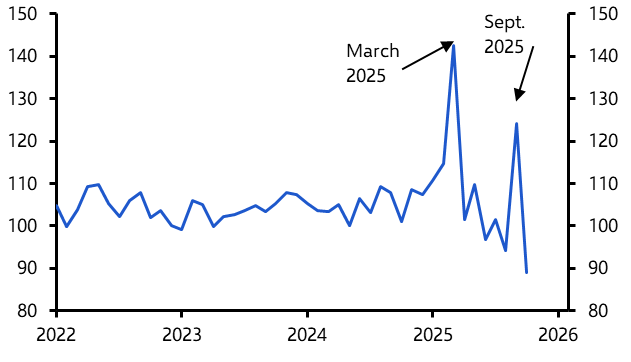

Chart 1: Goods Export Prices |

|

|

|

Sources: LSEG, Capital Economics |

- Regardless of the US election outcome, US-China decoupling will continue, with current account imbalances prompting further US measures to reduce imports from China. The current administration has tightened export controls and tariffs on Chinese goods. However, trade policy will vary depending on the election result. A Donald Trump administration would bring more instability, with tariff hikes and threats to leave the WTO. In contrast, a Kamala Harris administration would focus on technology controls, maintain US participation in the WTO, and take a more multilateral approach, offering greater stability in trade relations.

- Global shipping costs have fallen recently but remain nearly 60% higher year-to-date, nearly double pre-pandemic levels. The surge in spot freight rates since May was driven by outbound routes from Asia, though these costs have since decreased, indicating the peak of festive orders has passed. Rates to North America have remained higher due to traders anticipating potential US strike disruptions. New containerships will come online, easing capacity issues, but a lasting Gaza peace deal could further impact freight rates. However, changes in shipping costs are less impactful on inflation than often assumed.

- Despite falling global interest rates and a weakening US dollar, the near-term outlook for world trade is poor. Global goods exports stagnated in 2022 and 2023. In early 2024, trade saw a slight recovery driven by surging exports from China and emerging economies benefiting from AI and friendshoring, offsetting stagnant US and advanced economy exports. However, global manufacturing is now slowing, with new export orders declining, signaling a renewed drop in world trade. Lower interest rates may support a recovery next year, but changes in US trade policy post-election could prolong this lull into 2025.

Individually, these would be enough of a threat to the outlook. Together, they present a formidable challenge to global trade conditions. Businesses with exposure to global supply chains and investors with an eye on growth-inflation dynamics need to stay on top of each of these threats and be prepared for sudden shifts in the narrative. Our global team of economists helps them do that, providing clear and concise insight – backed by proprietary data tools – so decision-makers can respond quickly and confidently in the face of shifting trade conditions.