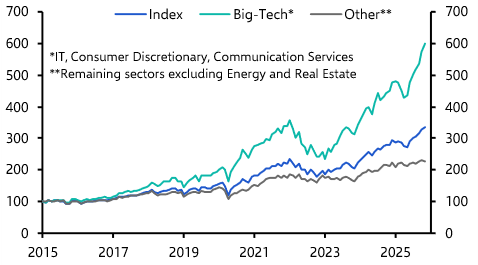

What are the risks and opportunities in global macro in 2025? In our latest briefing, Capital Economics’ senior economists shared their perspectives on the key themes for the coming year. From the implications of a second Trump administration to European political upheaval, the team outlined what to watch in an ever-changing macro and market landscape.

US policies and their global implications

Trump's proposed policies — depending on the extent to which they are implemented — would have significant economic implications. Tariffs, tax policies, and immigration reforms are expected to impact GDP growth, inflation, and key sectors like manufacturing.

European economic weakness and political risks

Europe’s outlook remains challenging, with sluggish growth, persistent structural issues, and political instability in countries like France and Germany. The eurozone also faces fiscal challenges, with widening bond spreads in economies such as Italy creating potential financial strain. As Europe continues to underperform other developed markets, we think attention may shift to focus on structural reform opportunities and ECB policy shifts.

China’s response to structural and tariff-driven challenges

China faces headwinds from US tariffs anticipated to be in region of 60%, slowing GDP growth, and persistent structural issues – including related to the property sector. While more fiscal and monetary interventions from the government are expected, the long-term challenges of overreliance on investment and the property sector will persist. Near-term government stimulus could create some opportunities, especially in domestic consumption, but navigating the longer-term economic transition requires caution.

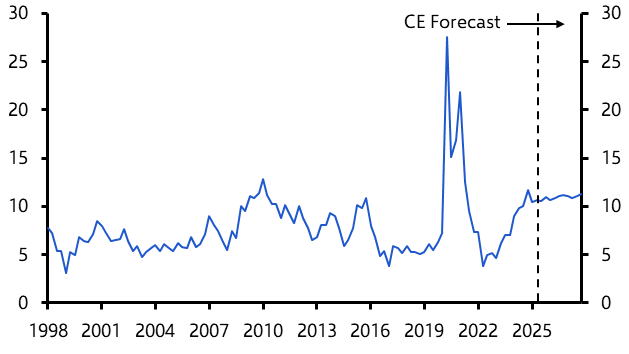

Global inflation and interest rates

As inflation across the advanced economies eases, we can expect modest rate cuts from major central banks, including the Fed and ECB.

The US dollar's continued dominance

Despite rising geopolitical tensions and discussions around currency alternatives, the US dollar remains resilient, accounting for 47% of global payments. Its influence on global trade and financial markets continues to be strong, with limited competition from other currencies such as the renminbi. Emerging market currencies and trade flows will still largely depend on dollar-denominated transactions.

These five trends highlight the changing dynamics of the global economy and markets in 2025. To learn more about these key trends, watch the full on-demand briefing.