Markets may be gripped by concerns about China’s economic health, but new data from Capital Economics suggests fiscal support is starting to provide a long-awaited boost that could help growth into 2025 as well.

However, the country’s longer-term economic outlook remains challenging, with the positive impact of government support set to fade and export growth to weaken, Capital Economics’ China team warns.

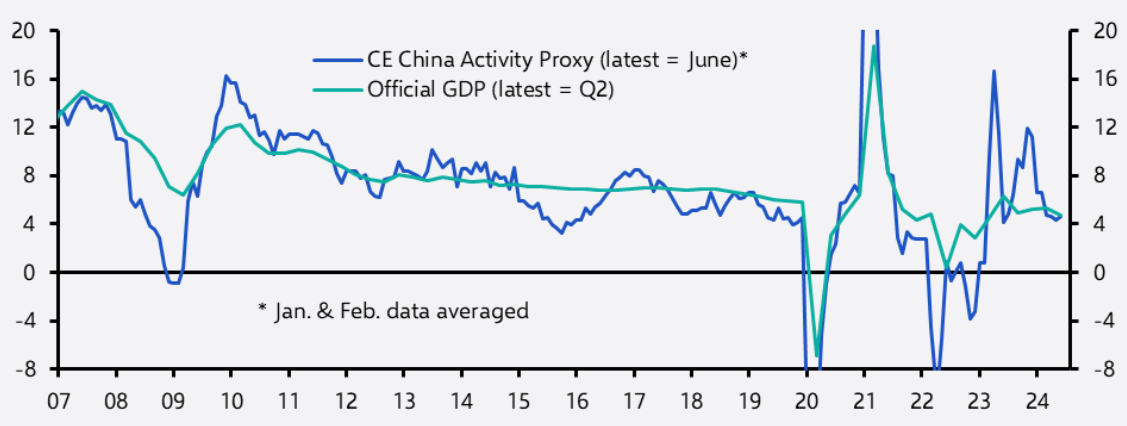

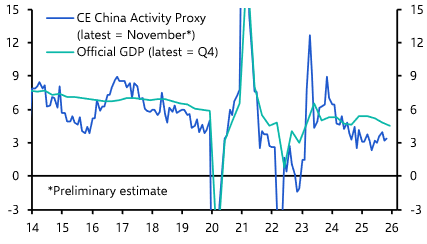

The China Activity Proxy, a proprietary growth measure that is published independent of official GDP data, ticked up to 5.4% in July from 5.3% in June, an improvement that chimes with official pledges to boost policy support and with fiscal spending turning positive after four months of year-on-year contractions.

|

Chart 1: Capital Economics China Activity Proxy & Official GDP (% y/y, seas. adj.) |

|

|

|

Sources: CEIC, WIND, Capital Economics |

A breakdown of CAP sector indices reflects the role that the government is playing in driving this near-term improvement, with the services sector proxy showing the biggest improvement. That reflects a recent pick-up in fiscal spending that has been focussed on areas such as research and development and education and healthcare.

In response to this latest data, Capital Economics now expects China’s recovery momentum to gather pace and has raised its 2025 economic growth forecast to 4.5% from 4%. However, its China Economics team also warned that this will be only a temporary economic boost.

“Policy support will continue to drive a cyclical recovery over the coming months,” said China Economist Leah Fahy. “But once support starts to fade and export growth weakens, the economy is set to slow again.”

Refreshed each month, the Capital Economics China Activity Proxy is one of the most highly regarded indicators for tracking the health of the Chinese economy. It was launched in 2009 to provide investors with a more accurate read of underlying growth without the inconsistencies introduced by official GDP data.

The Proxy now offers nearly two decades of data, including sector breakdowns, and is available to Capital Economics clients via Excel spreadsheet or interactive data dashboard.