The intense focus on this week’s US August employment report is hardly surprising. The July report, showing a smaller-than-expected 114,000 increase in jobs and a bigger rise in the unemployment rate, intensified recession fears and fuelled the global market sell-off that briefly shook summer trading last month.

While those worries about US recession have since receded and markets have recovered, another grim reading could spark fresh panic about the US outlook and increase bets that the Federal Reserve will start its easing cycle on 18th September with a 50-basis-point rate cut.

But our US team believes this upcoming report will show a reversal of some of the temporary factors that weighed on jobs growth in July. If so, that would give the Fed scope to begin easing with a more modest 25-basis-point move.

The team’s employment report preview argues that Hurricane Beryl, which hit the Gulf Coast in late June and early July, dampened payrolls growth in July to the tune of around 30,000 jobs, and that August will have seen these come back.

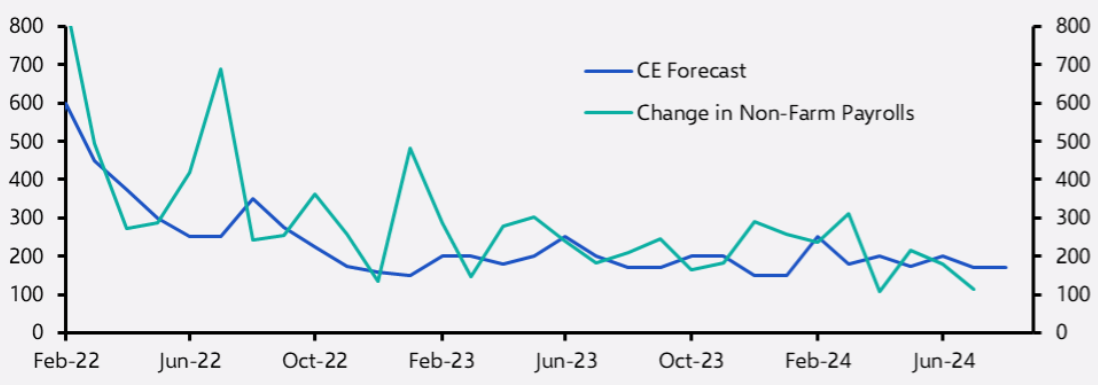

Of course, this is not the whole US jobs story. These one-off factors aside, indications are that the labour market is cooling, with hiring indicators in recent manufacturing and service sector surveys showing weakness. Taken together, this all points to trend employment growth slowing to 140,000 and implies – with Beryl’s impact reversed – that the Bureau of Labor Statistics will announce an August jobs increase of 170,000.

It's a similar story for the unemployment rate, whose rise to 4.3% in the July report from 4.1% triggered the Sahm rule, a measure of when recessions begin, and fuelled the financial market selling.

Our US team estimates that temporary layoffs accounted for a 0.15-pct-pt rise in the unemployment rate in July. If most these workers have been rehired – and the associated spike in initial jobless claims in July has receded, suggesting that they have been – then the unemployment rate could drop back to 4.2% or even 4.1%.

August’s sell-off turned out to be a market squall rather than a lasting storm, with recession fears easing thanks to a few upbeat US data releases which together suggested that a soft landing is still the most likely outcome (our proprietary US Scenarios dashboard shows the degree to which this is most likely).

Another bad employment report and those recession fears could be back. But our US team’s analysis shows why we think it’s more likely that August’s report will show a reversal of those factors that weighed in July, clearing the way for a quieter start to the Fed’s easing cycle.

|

Chart 1: Actual & Estimated Change in Non-Farm Payroll (000s) |

|

|

|

Sources: Refinitiv, Capital Economics |

Each month, our US employment preview provides essential context for one of the most closely tracked indicators in global markets. It’s part of a package of written analysis, proprietary data tools and regular briefings from economists that combined give clients the clearest possible insight into how the US economy is developing. Find out how we can give you clearer insight into the US economic outlook by requesting a free trial to our full suite of economic and market coverage.