In last week’s note I argued that there were signs that the economic collapse caused by the pandemic was bottoming out, but that the recovery was likely to be slow going and uneven. In this week’s note, I turn my attention to the longer-term consequences.

When thinking about the economic implications of any event it’s useful to distinguish between the effects on demand (spending by households, businesses, governments and foreigners) and the effects on supply (the capacity of an economy to produce goods and services).

According to the textbooks, it is shifts in demand that drive economic prospects over the short-term, while developments on the supply side determine long-term prospects. The problem is that, in practice, these shifts in demand can persist for long periods.

The immediate concern on the demand side is that the virus will induce a rise in precautionary savings by households and businesses. If so, this would depress demand and thus economic output (in the jargon, desired saving would exceed desired investment). The result would be low inflation, low real interest rates and a need for prolonged fiscal support in most economies. This could plausibly last for many years and is the main reason why we think GDP in most countries will remain below its pre-virus path for some time to come.

However, given time and sufficient policy support, demand should eventually recover and developments on the supply-side will take over as the main determinant of long-run growth prospects. These could be influenced in several ways by the virus.

Some of these influences will materialise relatively quickly in certain industries. For example, permanent social distancing measures have the potential to severely restrict supply in sectors such as restaurants, hotels and transportation. These industries will be among the slowest to recover and face the greatest immediate challenges and may never fully recover. (We will shortly be launching a series of sector briefs that explore the prospects for different industries in a post-virus world - to register your interest, click here.)

At an aggregate level, however, the supply potential of an economy is governed by three factors: the amount of workers it has, the amount of capital it provides to these workers, and the efficiency with which it utilises both labour and capital. This is a complex mix at the best of times, and the truth is that we simply don’t know at this stage how each of these factors are likely to be affected by the shock caused by the pandemic. However, it is at least possible to identify the issues that will be critical to determining any long-term damage to growth.

A lot will hinge on how long the virus lasts. The longer disruption and uncertainty persist, the greater the risk that unemployment stays high (meaning workers lose skills and discouraged workers leave the labour force) and investment stays weak (meaning the capital stock diminishes). Both would weigh on long-term growth prospects.

The extent to which the virus results in a fundamental change in behaviour will also play an important role. Unlike in a war, the virus has not resulted in a widespread destruction of capital. But it could result in an effective destruction of capital if, for example, it gives rise to a world in which more people work from home and shop online and fewer people travel. This would render large amounts of capital, including office and retail space, and airports and hotels, redundant.

Set against this, however, is the possibility that the virus ushers in a new wave of investment in technology. The need to reconfigure workplaces to incorporate social distancing could require new investments, including in robotics and AI. And there’s likely to be a greater emphasis on research and development, particularly in the realm of public health. All of these would be positive for long-run growth.

Finally, a big unknown is how the international dimension of the virus will play out with respect to globalisation. It is possible that the costs incurred due to the absence of a coordinated response to the virus will focus attention and lead to greater regional and global co-operation in future. It is too early to say how it will develop, but the recent move towards greater fiscal integration in Europe is potentially a major step forward for the euro-zone. Despite this, however, it is much easier to see how the virus could accelerate the trend towards de-globalisation that was already underway before the pandemic struck.

One aspect of this relates to global supply chains, and the possibility that firms may seek to shorten them to build greater resilience to global shocks. Another relates to the possibility that migration flows may slow as international travel becomes more difficult. But a far bigger risk, in our view, is that the virus causes countries to turn inwards and provides more fodder for nationalist governments. This in turn would hasten the shift to a multi-polar world, with separate spheres of influence led by the US, China, and perhaps Europe.

Seismic global events – and the coronavirus is clearly one of these – can profoundly reshape political systems, economies and societies. That said, none of this preordained or out of the control of governments. The response of policymakers will be crucial in determining the long-term effects. Will governments pursue growth-stimulating agendas that incentivise investment in new technologies or will they succumb to populism? Will higher debt burdens result in more austerity or will governments (and markets) find ways of living with more debt? And will the virus usher in a new era of co-operation or will it cause countries to turn inwards?

In the coming months we will publish a series of pieces that will explore all these issues in detail, culminating in a programme of (inevitably virtual) events in the autumn/fall. This is a subject to which I’ll return in future notes.

In case you missed it:

- Our Chief Property Economist, Andrew Burrell, identifies the metro areas that are likely to lead a recovery in US commercial property (good news for DC and San Francisco).

- Our UK team argues that the Bank of England is likely to keep interest rates at their current record low for at least five years.

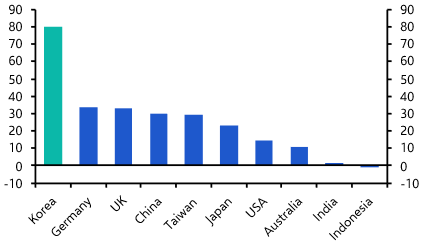

- Our Senior Economic Advisor, Vicky Redwood, identifies those countries that can run primary budget deficits and still stabilise their public debt burdens – and those that will need to run primary budget surpluses.