Growth, inflation, and rates to be lower than expected

Q1 2024 Global Economic Outlook

The combination of tight monetary policy and fading tailwinds that propped up activity during this past year should conspire to cause growth to weaken across advanced economies.

These are the key takeaways from our Q1 Global Economic Outlook, originally published on 13th December, 2023. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Economics coverage.

We think that global growth will undershoot consensus expectations in 2024 as the lagged effects of monetary policy tightening filter through. Among the advanced economies, the US will continue to outperform Europe. And while China’s policy-induced recovery is set to continue in the near term, strong structural headwinds will put the economy back on a weaker track by the second half of 2024. The subdued growth environment is likely to bring inflation back to central banks’ targets sooner than most anticipate. Accordingly, central banks should be able to cut interest rates back to more neutral levels almost across the board. Upcoming elections won’t be a game-changer for global growth, but some may influence how the world economy continues to fracture along geopolitical lines.

- While the world economy should essentially experience a soft landing from this monetary tightening cycle, we think that global growth will undershoot consensus expectations in 2024. With inflation set to fall close to – or actually reach – central bank targets in the coming year, 2024 should also be a year of broad-based cuts in policy interest rates.

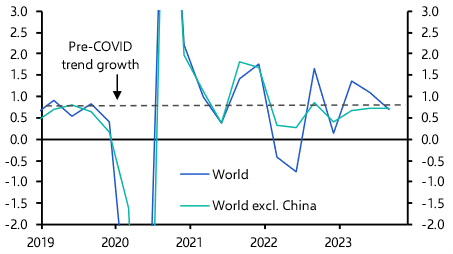

- Global GDP growth in 2023 is on course to be roughly in line with its pre-virus trend rate, at just over 3%. While this is flattered by China, growth in the rest of the world has been only a little below its trend rate in total (see Chart 1), which is better than we and others had forecast. But we don’t believe that this resilience can endure, particularly in advanced economies.

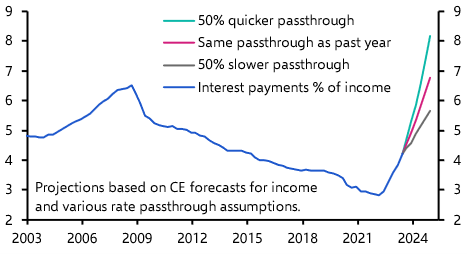

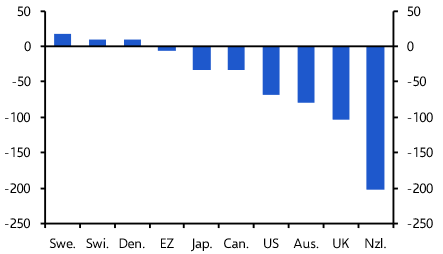

- For one thing, monetary policy should drag on growth in 2024. Admittedly, the passthrough of interest rates to activity is proving to be weaker than in previous cycles. But monetary policy is not entirely impotent. Higher interest rates have already caused liquid money growth and bank lending to slow sharply. And higher policy rates are gradually feeding through to debt service costs. As income growth slows in the year ahead, rising interest payments should eat up a larger share of household incomes (see Chart 2), especially in the likes of Australia and New Zealand, where rate passthrough is stronger.

|

Chart 1: GDP (% q/q) |

Chart 2: Household Interest Payments as a % of Income |

|

|

|

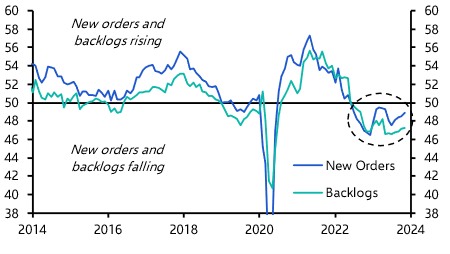

- What’s more, the big falls in commodity prices and shipping costs, and the unwinding of bottlenecks in global supply chains that propped up manufacturing in 2023 are now in the rear-view mirror. Manufacturers are left heading into 2024 with new orders continuing to contract (see Chart 3), but with no new help on the supply side to prop up production.

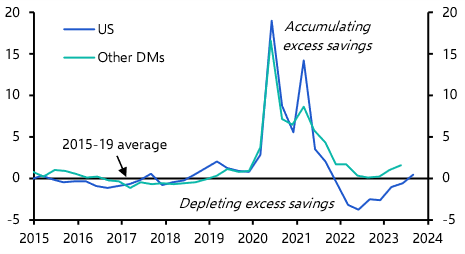

- Moreover, the boost to demand from reduced saving has probably run its course. In the US, households will have exhausted the savings they built up during the pandemic by the end of 2023. And, as for most other DMs, households are not showing any sign of following in the US’ footsteps by running down accumulated savings to fund higher spending. (See Chart 4.)

|

Chart 3: Global Manufacturing PMI: |

Chart 4: Flow of Household Saving as a % of Income |

|

|

|

- Consequently, the outlook for consumer demand will hinge more on income growth, which we expect to slow. All else equal, lower inflation should help boost income growth in real terms. But going by the trend decline in job vacancies and softening of hiring intentions, employment growth is likely to continue to weaken in the quarters ahead. (See Chart 5.) And with labour markets loosening, nominal average income growth should ease too.

- The combination of tight monetary policy and fading tailwinds that propped up activity during this past year should conspire to cause growth to weaken across advanced economies. Within DMs, Europe is likely to keep underperforming the US due to a mixture of still-elevated energy prices, a stronger interest rate passthrough and, in the euro-zone at least, tighter fiscal policy.

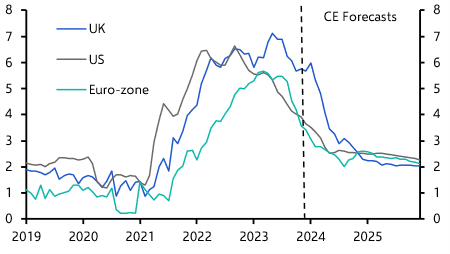

- Below-trend growth, cooling labour markets, and a pipeline of falling goods price pressures will see core inflation drop close to 2% by the second half of 2024. (See Chart 6.)

|

Chart 5: G7 Average Labour Indicators (Z-Scores) |

Chart 6: Core Inflation (%) |

|

|

|

- In turn, this should ultimately prompt more rate cuts in many DMs than investors currently expect (see Chart 7), taking policy back to a neutral stance.

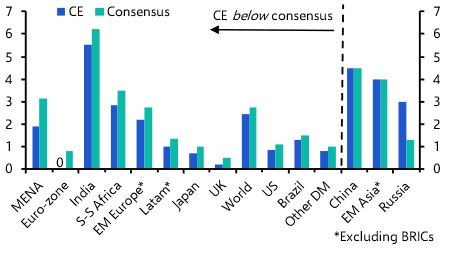

- Like in advanced economies, our 2024 GDP growth forecasts for EMs mainly lie below consensus. (See Chart 8.) We are seemingly in agreement with other forecasters about China’s economy continuing its cyclical recovery in the coming quarters. But the bigger story is that China’s structural challenges will prevent such rates of growth being sustained in future years.

|

Chart 7: CE less OIS-Implied End-2025 Policy Rates (%) |

Chart 8: CE vs. Consensus 2024 GDP Forecasts (% y/y) |

|

|

|

|

Chart Sources: Refinitiv, S&P Global, Focus, Capital Economics |

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown, Simon MacAdam, Ariane Curtis and Lily Milard, originally published on 13th December, 2023. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – The lagged impact of previous monetary policy tightening should push GDP growth well below potential in the coming quarters. This should help bring core inflation back to target by mid-2024, prompting the Fed to cut rates by more than investors anticipate, starting in March.

Euro-zone – We expect the euro-zone economy to broadly stagnate over the first half of 2024. And as core inflation continues to fall back towards target, we expect the ECB to pivot to rate cuts as soon as April.

Japan – Economic activity looks set to slow in 2024. But early signs that wage growth will rise should convince the BoJ to lift rates out of negative territory and formally end yield-curve control next year.

UK – We still think the UK will experience a mild recession. But lingering restraints on supply will keep core inflation higher than elsewhere, preventing the Bank of England from cutting policy rates until late 2024.

Canada – Weak GDP growth and further falls in inflation will prompt the BoC to cut rates early next year.

Australia & New Zealand – We think that both economies will narrowly avoid a recession.

China – The step-up in policy support and an uptick in consumer spending should continue to drive a modest cyclical recovery at the start of 2024. But various structural headwinds mean the recovery won’t be sustained.

India – Growth will remain strong ahead of next year’s election, and the RBI won’t cut rates until H2 2024.

Other Emerging Asia – Weak global demand will weigh on GDP growth across the region in the near term.

Emerging Europe – Inflation risks are elevated, meaning monetary policy will remain tighter than most expect.

Latin America – The resilience in economic activity in Brazil and Mexico will fade in 2024.

Middle East & North Africa – Unwind of Gulf oil output cuts will only be gradual, keeping GDP growth muted.

Sub-Saharan Africa – Tight policy will keep a lid on economic recoveries across the region.

Commodities – While we expect most commodity prices to rise, oil prices should buck the trend as a gradual unwind of voluntary production cuts by OPEC+ weighs on prices.

Get the full report

Trial our services to see this complete 34-page analysis, our complete Global Economics insight and forecasts and much more