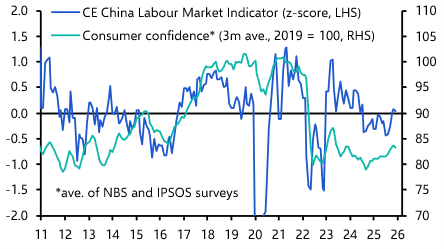

It was meant to be a discussion all about the upside and downside risks that clients should keep an eye on in 2023. But a growing online debate about attempts to push the renminbi in energy trade between China and the GCC countries sidetracked it. Group Chief Economist Neil Shearing does talk about potential inflation surprises – both positive and negative – and address what post-zero-COVID China could mean for the 2023 global outlook. But his conversation with David Wilder also takes in geopolitical risk, and that brings up the faddish idea of a "petroyuan" and whether it could displace the US dollar's status as the dominant reserve currency. Also this week, Mark Williams and Julian Evans-Pritchard from our China team talk about what's really happening on the ground in China following the government's abrupt public health policy U-turn and what that means for the timing of an economic recovery. You'll find the research referenced in this episode here.

Podcast Episode