Neil Shearing has been in back-to-back meetings with global institutions who – like everyone – are trying to make sense of Trump’s chaotic trade policy roll-out, not least the recent decision to pause "reciprocal" tariffs for 90 days. The Group Chief Economist at Capital Economics joins the latest episode of The Weekly Briefing to address some of the questions that have kept coming up in those sit-downs with clients, including:

- What the global trading picture might look like when the 90-day tariffs “pause” ends

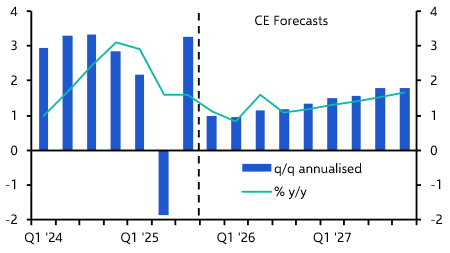

- Why we think US growth risks have risen but we still don’t expect a recession

- How the Federal Reserve will play slower growth with higher inflation

- What curbs on Nvidia chips tells us about decision-making amid Trumpian uncertainty

- If there’s a US-China trade deal to be done

Analysis referenced in this episode:

Read: Will tariffs drive a flood of Chinese exports elsewhere?

/publications/global-economics-focus/will-tariffs-drive-flood-chinese-exports-elsewhere

Read: Is China offloading its dollar assets?

/publications/china-economics-focus/china-offloading-its-dollar-assets

Data: Tariff Impact Model (TIM)

/data-and-charts/tariff-impact-model

Read: US Outlook - Scaled-back tariffs not an existential threat

/publications/us-economic-outlook/scaled-back-tariffs-not-existential-threat

Read: ECB Policy Announcement (April 2025)

/publications/europe-rapid-response/ecb-policy-announcement-april-2025

Read: Will tariffs drive a flood of Chinese exports elsewhere?

/publications/global-economics-focus/will-tariffs-drive-flood-chinese-exports-elsewhere

Read: Is China offloading its dollar assets?

/publications/china-economics-focus/china-offloading-its-dollar-assets

Data: Tariff Impact Model (TIM)

/data-and-charts/tariff-impact-model

Read: US Outlook - Scaled-back tariffs not an existential threat

/publications/us-economic-outlook/scaled-back-tariffs-not-existential-threat

Read: ECB Policy Announcement (April 2025)

/publications/europe-rapid-response/ecb-policy-announcement-april-2025