Prop from stimulus to be short-lived

Q2 2024 China Economic Outlook

China’s economy has fared better recently and policy support is likely to remain a near-term prop to growth. But we remain less sanguine about the medium-term outlook.

These are just some of the key takeaways from our latest quarterly China Economic Outlook, originally published on 27th March, 2024. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term financial markets analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated China Economics coverage.

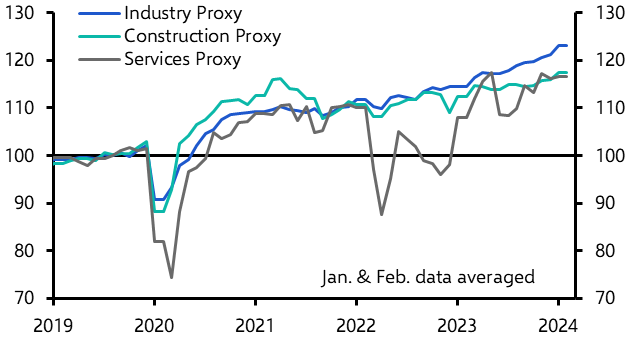

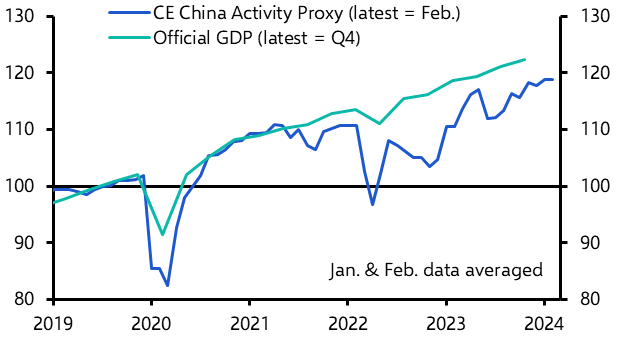

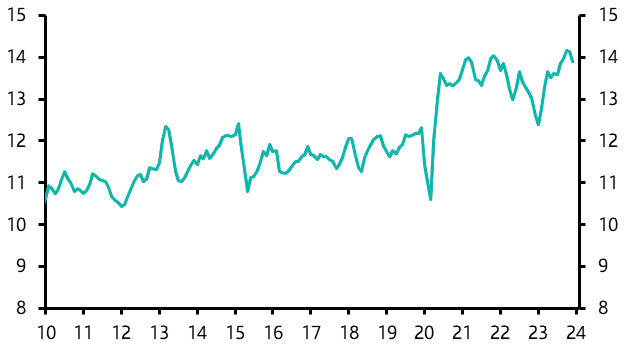

Our China Activity Proxy (CAP) suggests that the Chinese economy has since regained some momentum after a marked reversal of the post-zero-COVID recovery last summer. (See Chart 1.) The CAP breakdown shows that the industrial sector has been the star performer, while services and construction activity continue to lag somewhat. (See Chart 2.)

|

Chart 1: Official GDP & CE China Activity Proxy |

Chart 2: CAP – Sector Proxies (2019 = 100, seas. adj.) |

|

|

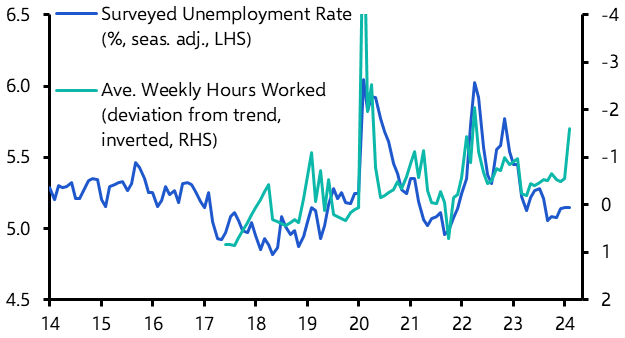

- We think the economy will do reasonably well in the short-run. Admittedly, the labour market appears to be softening again (see Chart 3), which doesn’t bode well for wage growth. Coupled with increasingly negative wealth effects from property price falls, the prospects for an acceleration in consumer spending have dimmed.

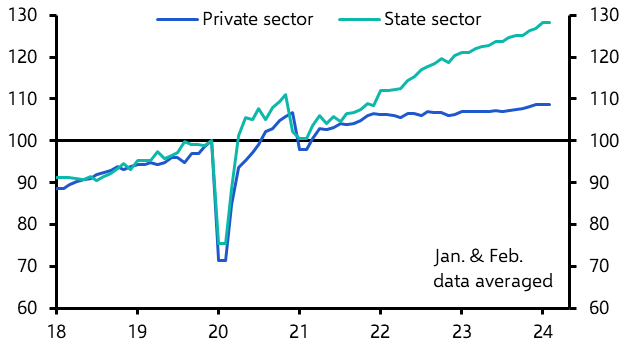

- Instead, the main near-term prop will come from investment, which is being buoyed by policy stimulus. Rate cuts are doing little to boost capital spending by private companies, which remain wary. But fiscal support is lifting investment by the state sector. (See Chart 4.)

|

Chart 3: Unemployment Rate & Hours Worked |

Chart 4: Fixed Investment (2019 = 100, seas. adj.) |

|

|

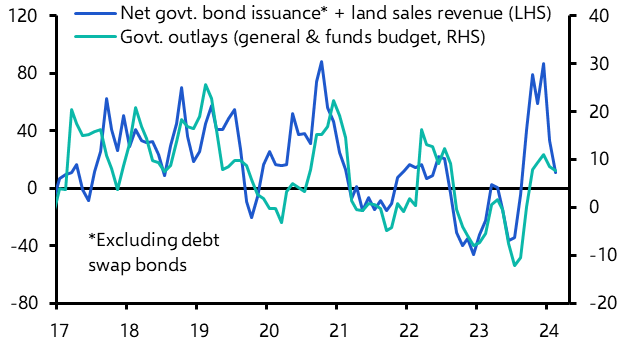

- Although government borrowing has slowed in recent months, many of the proceeds from the surge in bond issuance late last year have yet to be spent. They should keep government spending strong in the near-term. (See Chart 5.) And the looser fiscal stance detailed at the National People’s Congress suggests that government borrowing will tick up again in the coming months.

- The drag from the property downturn may also alleviate somewhat in the near-term. Regulatory barriers to home purchases have been reduced and affordability has improved considerably. (See Chart 6.) Sales have overcorrected relative to underlying demand. The main factor holding them back is homebuyers’ lack of confidence in the ability of developers to deliver presold homes. Greater credit support for developers could help address this, while also slowing the decline in property investment.

|

Chart 5: Govt. Outlays vs Revenue from Borrowing & Land Sales (3m % y/y) |

Chart 6: New House Price-to-Income Ratio |

|

|

- But the relief provided by policy support is likely to be temporary and we think the economy will be weakening again by year-end. The biggest cloud hanging over the outlook is the substantial but still necessary downward adjustment in construction activity that has yet to take place. Stimulus can defer it for a while, but not indefinitely.

- The prop from exports may also start to moderate later this year. Chinese export volumes have risen 20% over the past year, despite global trade being stagnant. This sharp gain in global market share (see Chart 7) was fuelled by aggressive price cuts. But this strategy was not sustainable and prices have rebounded recently. Flooding foreign markets with cheap goods also risks triggering a protectionist backlash.

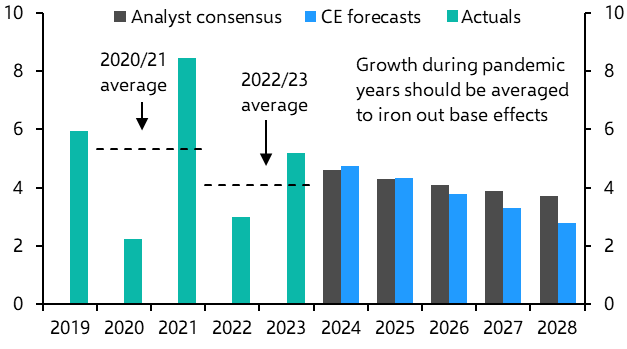

- The big picture is that policymakers are still failing to tackle the structural imbalances that undermine the sustainability of Chinese growth. If anything, by focusing on the supply-side of the economy, the current round of stimulus will make matters worse – offering a short-lived boost at the expense of a more painful adjustment down the road. We continue to think growth will slow more over the medium-term than most anticipate. (See Chart 8.)

|

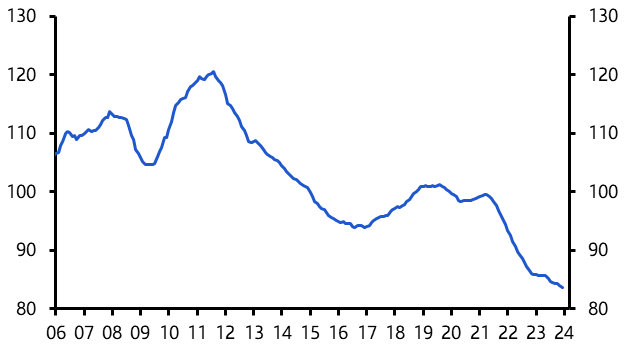

Chart 7: China’s Share of Global Goods Exports (%, 3m average, 2010 prices, seasonally-adjusted) |

Chart 8: Official GDP (% y/y) |

|

|

Sources: CEIC, Refinitiv, Capital Economics

Don't miss out on the full analysis and comprehensive forecasts, including:

- Why state investment can make up for lacklustre consumption, but only in the short-run.

- How China’s exporters have slashed prices to sustain sales in the face of weaker global demand. But they won’t be able to continue doing this and export volume growth will slow as a result.

- What the PBOC will do to keep providing monetary support, but why it won't be on a large enough scale to have a meaningful impact.

- How policymakers have eased constraints on government borrowing, which will help to boost spending. But concerns about debt levels mean that fiscal policy is unlikely to remain so loose for long.

- Why policy support measures for the property sector haven’t succeeded in driving up new home sales so far. Plus, why we remain hopeful that further easing will result in a near-term recovery, but the longer-term outlook for the property sector remains bleak.

Get the full report

Trial our services to see this complete 12-page analysis, our complete China economic insight and forecasts and much more