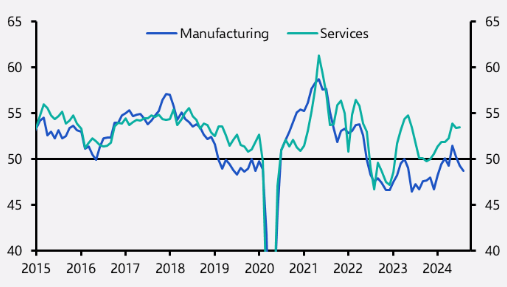

For proponents of the idea that the global economy is tipping into recession, the evidence provided by recent manufacturing surveys is front and centre.

Those surveys have fed market worries that the surge in interest rates of recent years will end with economic hard landings. But that’s not our base case; our economists are advising clients that the world’s major economies are in a soft patch, but also that the coming year will see a modest recovery.

For the manufacturing sector, the risks of a more severe downturn have increased in advanced economies, but a slowdown in the sector remains the more likely outcome, says Senior Global Economist Ariane Curtis in a new report.

Curtis identifies potential triggers for a further leg down in output, including weakening forward-looking components in the DM manufacturing PMIs and more limited scope for firms to work through backlogs or rebuild inventories post-pandemic.

|

Chart 1: S&P DM PMIs: Output |

|

|

|

Sources: Refinitiv, S&P Global, Capital Economics |

Anecdotal evidence that political uncertainty in the US held back some firms there from purchasing equipment in August could also translate into further falls in orders until that overhang clears, she said.

Despite these potential challenges, Curtis also explains how central bank policy easing cycles in advanced economies create a more favourable environment for rate-sensitive purchases. Loan demand increased in Q2, and banks expect further growth in Q3 as lending standards loosen, Curtis notes.

Furthermore, the PMIs of Asian economies like Taiwan and Korea, which often serve as better indicators of global manufacturing trends than the US, remained near two-year highs in August, indicating continued solid growth in new orders.

And even if there is a more severe downturn, fears that this could cause a broader recession are misplaced. Manufacturing accounts for a relatively small share of GDP in most advanced economies, ranging from about 5% in Australia to 18% in Germany. The data also show been numerous instances when manufacturing output contracted but GDP remained positive.

“While the risk of a more significant downturn in manufacturing has probably increased in recent months, on balance we still think that soft landings in advanced economies, including in the US, are the most likely outcome,” Curtis says.

While manufacturing is facing potential challenges, central bank easing and other indicators suggest a modest recovery ahead. Staying informed on these dynamics can help you navigate uncertainties, make strategic investment decisions, and protect your portfolio against downturns. Request a free trial to access our analysis and data to gain deeper insights and position yourself for success in a shifting global economy.